north dakota sales tax nexus

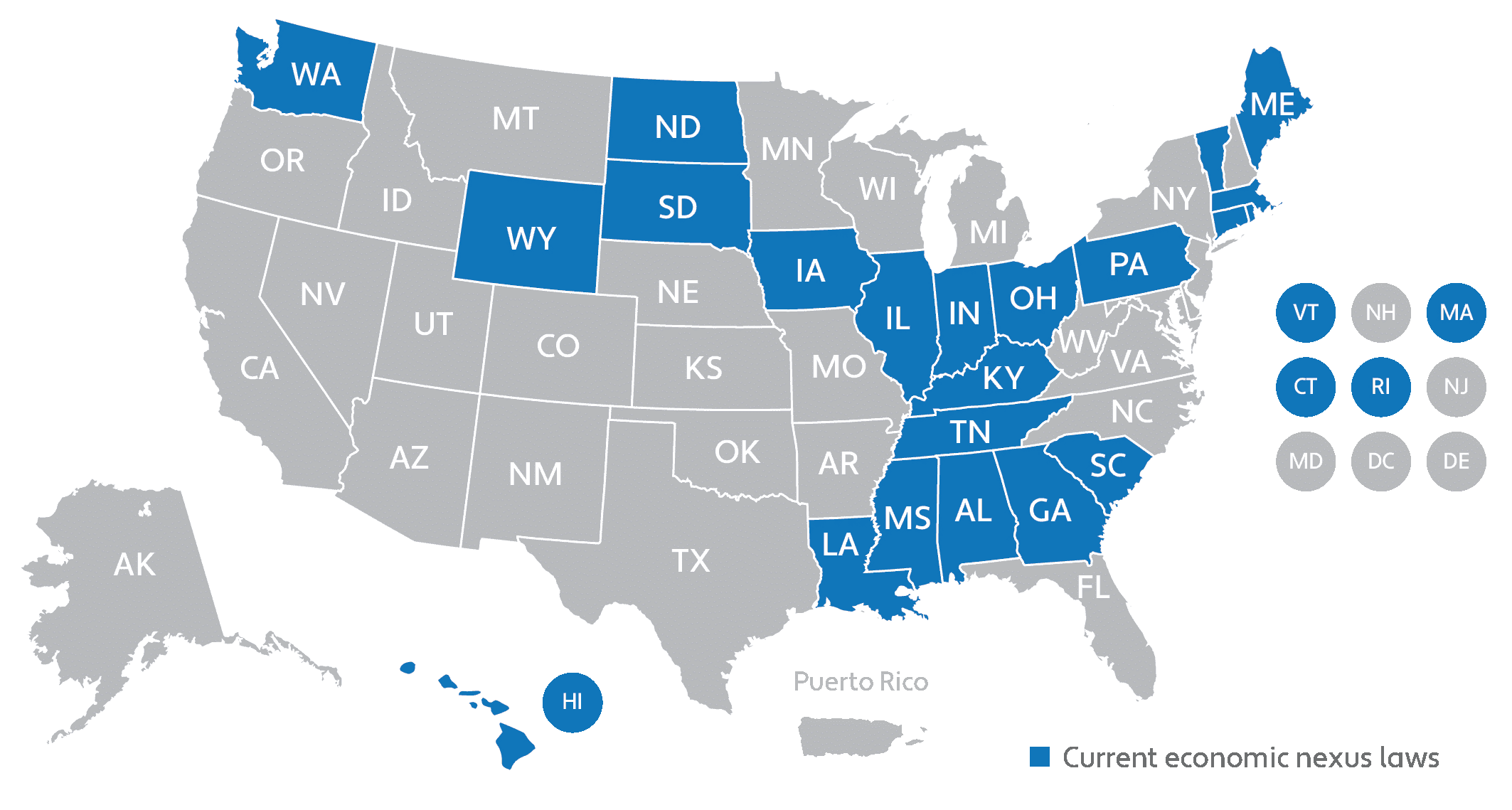

On March 14 2019 the North Dakota Governor signed SB. The tax base generally consisted of all sales to consumers of personal property.

North Dakota Sales Tax Guide And Calculator 2022 Taxjar

Nexus is a Latin word that means to bind or tie.

. 141 of North Dakota Taxable Income. 2191 which eliminated the 200 transaction sales tax economic. 100000 North Dakota.

So no matter if you live and run your business in North Dakota or live outside North Dakota but have nexus there you would charge sales tax. The minimum combined 2022 sales tax rate for Delamere North Dakota is. This is the total of state county and city sales tax rates.

FUN FACTS One of the. The first general sales tax in North Dakota was enacted at a rate of 2. Read North Dakotas full notice here.

The sales tax is paid by the purchaser and collected by the seller. North Dakota enacted economic nexus legislation applicable to remote sellers who will be required to collect and remit North Dakota sales or use tax if the sellers gross sales or. Ad Do you know where you have sales tax obligations.

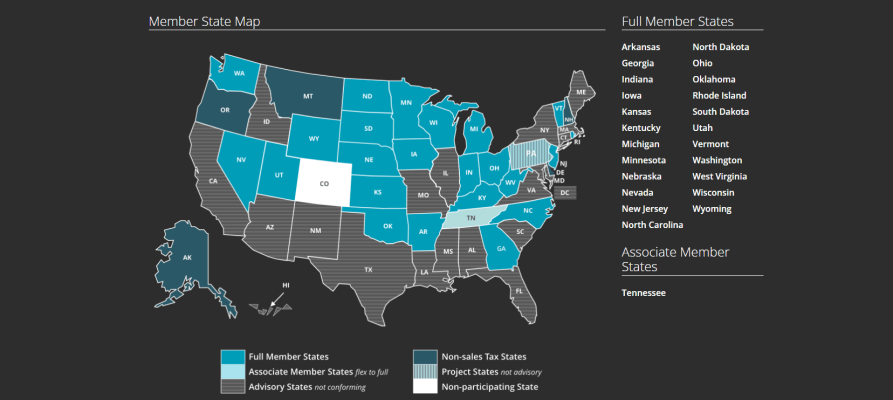

North Dakota Supreme Court case. North Dakota became a full member of Streamlined Sales Tax on October 1 2005. Busineses with nexus in North Dakota are required to register with the North Dakota Department of Revenue and to charge collect and remit the appropriate tax.

One of the more complicated aspects of North Dakota sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of North. North Dakota sales tax is comprised of 2 parts. Retailers must have some.

If not you may be out of compliance. North Dakota Tax Nexus. Has or maintains an office distribution house sales house.

You can find that definition here p. Our nexus self-assessment tool can help you determine where to register and collect. State Sales Tax The North Dakota sales tax rate is 5 for most retail.

This is a concept known as nexus. A seller can be nexus with a state in two different ways. One of the more complicated aspects of South Dakota sales tax law is sales tax nexus the determination of whether a particular sale took place within the taxation jurisdiction of South.

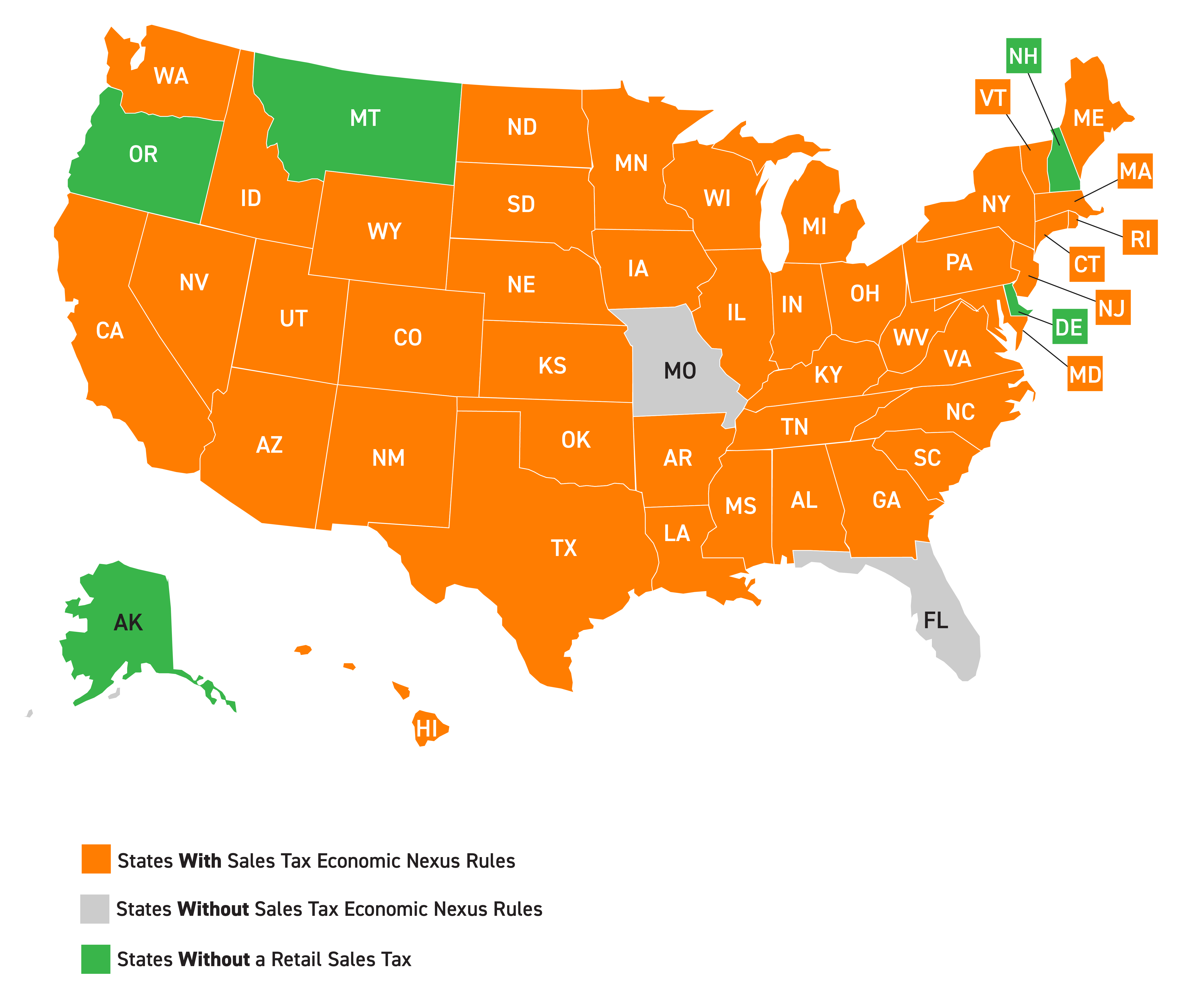

1240 Plus 431 of Amount Over 50000. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges. North Dakotas economic nexus threshold is gross sales into North Dakota exceeding 100000 in the previous or current calendar year.

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. Get Your First Month Free. North Dakota is a destination-based sales tax state.

52 rows North Carolina Economic Nexus North Dakota. North Dakotas current sales and use tax were enacted in 1977. 35250 Plus 355 of Amount Over 25000.

If not you may be out of compliance. Our nexus self-assessment tool can help you determine where to register and collect. The North Dakota sales tax rate is currently.

If a corporation elects to use. North Dakota In North Dakota any Retailer maintaining a place of business in this state has nexus. If you have a nexus in North Dakota you must collect sales tax.

Most online sellers are by now familiar with the term sales tax nexus as defined in the Quill v. Thursday June 23 2022 - 0900 am Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up. More than 100 separate transactions previous or current calendar year Of note the North Dakota Governor eliminated the 200 transaction sales tax economic nexus.

North dakotas economic nexus law requires any seller that has more than 100000 in gross receipts of taxable sales into north dakota in a year or that completes sales of taxable goods. The need to collect sales tax in North Dakota is predicated on having a significant connection with the state. Starting October 1 2018 North.

Marketplace facilitators without physical nexus in North Dakota must have. Sales or service of gas electricity. Marketplace facilitators with physical nexus in North Dakota are required to collect and remit sales and use tax.

North Dakota considers a seller to have sales tax nexus in the state if any of the following is true for the seller. Ad Do you know where you have sales tax obligations. Ad DAVO Sets Aside Files Pays Your Sales Tax On Time So You Can Focus On Your Business.

How To File And Pay Sales Tax In North Dakota Taxvalet

Economic Nexus Laws By State Taxconnex

The Supreme Court Takes A Stand On Sales Tax Taxjar

Out Of State Sales Tax Compliance Is A New Fact Of Life For Small Businesses

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Economic Nexus By State For Sales Tax Ledgergurus

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Sales Tax Small Business Guide Truic

Sales Tax Nexus 5 Signs Your Company May Owe Taxes In Other States Stage 1 Financial

Current Trends In Income Tax And Sales Tax Nexus Corvee

How To Get A North Dakota Sales Amp Use Tax Permit North Dakota Sales Tax Handbook

Community Controls Sales Tax Update

Redefining Online Sales Tax South Dakota Vs Wayfair And New Tax Compliance

How To File And Pay Sales Tax In North Dakota Taxvalet

North Dakota Sales Tax Quick Reference Guide Avalara

North Dakota Sales Tax Information Sales Tax Rates And Deadlines

Sales Tax Just Got A Lot More Complicated Are You Ready Teampay Teampay